pa local tax due dates 2021

When amending a PA Income Tax Return PA-40 you must also file an amended local earned income tax return. The property tax year in your area is the calendar year.

List all income from W-2 wages and W-2G winnings reported in 2021 and the amount of localci ty tax withheld while living in a RITA municipality.

. You didnt withhold your unemployment income. 2021 PA Realty Transfer Tax and New Home Construction Brochure. 2022 Pennsylvania Wine Excise Tax Due Dates.

Returns - No Tax Due WH1605 WH1605Z WH1606 WH1606Z Returns - Balance Due. PA-1 -- Online Use Tax Return. Your social security number Spouses social security number Your first name and.

A year end reconciliation for LST Tax is not required. Face amount due for payments postmarked or delivered to the City Treasurers Office on or before June 15 2022. Final estimated tax payment for 2021 due.

IRS begins processing 2021 tax returns. 2022 Pennsylvania Wine Excise Tax Due Dates REV-1829 -- 2021 Pennsylvania Wine Excise Tax Due. Late or incorrect filing.

You will need to submit your Home State Return or both your Visa PA Non-Resident Return. TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLGS-32-1 10-21 You are entitled to receive a written explanation of your rights with regard to the audit appeal enforcement refund and collection of local taxes. An Act amending the act of March 4 1971 PL6 No2 known as the Tax Reform Code of 1971 in sales and use tax further providing for definitions.

Be sure to check the Amended Return box on the Form. Quarterly Estimated PaymentsCredit from Previous Tax Year. Penalty amount Face plus 10 due for payments postmarked or delivered to the City Treasurers Office between June 16 and December 30.

Taxpayers Can Use myPATH for PA Personal Income Tax Filing Prior to Filing Deadline N. You agreed to pay all taxes due after the date of sale. The taxes due in 2022 for 2021 will be.

Go to Page 3 Schedule K Line 34 to calculate tax due. This line serves taxpayers without touch-tone telephone service. PA-100 -- Pennsylvania Online Business Entity Registration.

Filing deadline for tax year 2021. States are providing tax filing and payment due date relief for individuals and businesses. Free MilTax service for military opens to prepare 2021 returns.

Second estimated tax payment for 2022 due. Dates Wages Were Earned. The AICPA has compiled the below latest developments on state tax filings related to coronavirus.

2022-06-01 To House Finance Committee. Earned Income Tax Balance Due Line 9 minus line 1300. First estimated tax payment for tax year 2022 due.

Penalty after April 18 Multiply line 16 by 00. With millions of Americans filing for unemployment benefits. The taxes due in 2021 for 2020 were 1375.

Under state law the taxes become a lien on May 31. Total Local Earned Income Tax Withheld as Reported on W-2s00. 12921 10 am et also see 2020 State Tax Filing Guidance for Coronavirus Pandemic US.

April 30 July 30 Oct 30 and Jan 30 An annual Individual Earned Income Tax Return must be filed with the YATB by April 15 following the end of the tax year. 2021 State Tax Filing Guidance for Coronavirus Pandemic updated. So if your tax refund is less than expected in 2021 it could be due to a few reasons.

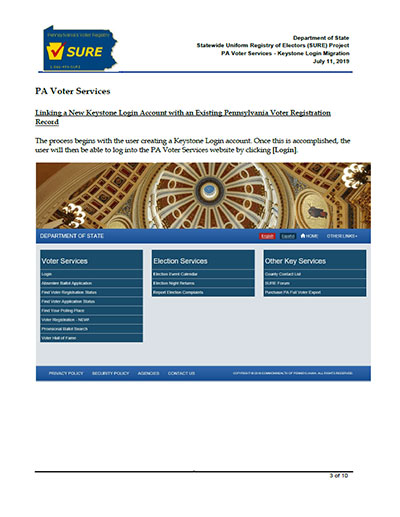

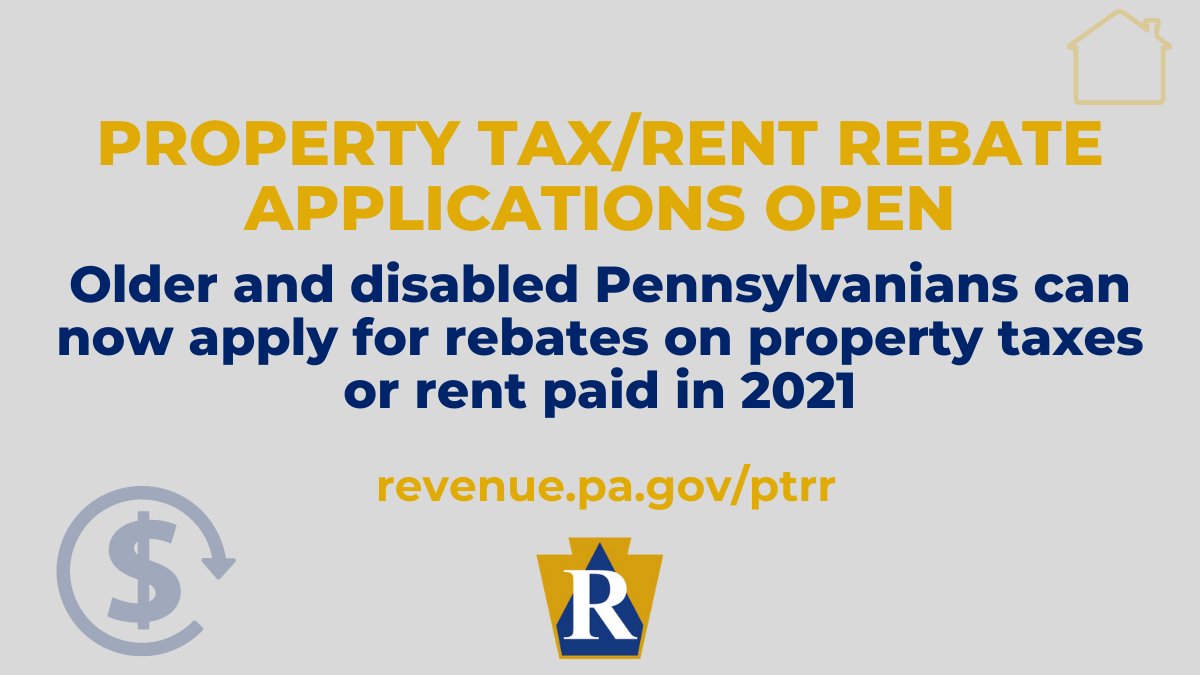

Consistent with the PA DOR and our surrounding states LCTCB does not consider working from home temporarily to be a change in the employees work location. Pennsylvania Consumer Fireworks Tax Due Dates. 2021 Property Tax Rent Rebate Program Information.

If a person is self-employed or works out-of-state the tax must be estimated and paid quarterly. Paper W-2s W-2Cs W-2Gs or 1099s Correspondence Refund or Zero Return South Carolina Department of Revenue Withholding PO Box 125 Columbia SC 29214-0004. Harrisburg PA With the deadline to file 2021 personal income tax returns a week away the Department of Revenue is reminding Pennsylvanians that th.

The taxes for the previous year are assessed on January 2 and are due on May 31 and November 30. This remains in effect until the earlier of 90 days beyond the end of Governors emergency declaration or June 30 2021. If the tax is not paid when due penalty may be imposed at the statutory rate 30 days after notice to take corrective action.

Retailers Information - State and Local Sales Use and Hotel Occupancy Tax - Public Transportation Assistance Fund Taxes and Fees - Vehicle Rental Tax. Income Tax Return Instruction Booklet PA-40 2021 Pennsylvania Personal Income Tax Return Instructions PA-40 IN email protected Automated 24-hour Forms Ordering Message Service. The unemployment rate skyrocketed in the US.

YATB collects the tax for Adams County.

Pa Office Of Administration Facebook

Where S My Refund Pennsylvania H R Block

W9 Writeable 2021 Irs Forms Calendar Template Printables

Donate Helpful Accessible House Nicene Creed

Christkindlmarkt In Bethlehem Pa Christmas City Bethlehem Bethlehem Pa Christmas Market

Tax Trends Finance Newtown Township

Pennsylvania Department Of Revenue Parevenue Twitter

Pa Office Of Administration Facebook

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue Parevenue Twitter

Pa Office Of Administration Facebook

Everything You Need To Know About The Pa Medicaid Program

.png)